For most salaried individuals, the Employees’ Provident Fund (EPF) forms the backbone of their savings needs. Now the scheme is undergoing sweeping changes.

Apart from recent tweaks in rules, new measures proposed could change the EPF’s very structure. So will the changes enhance the utility of the EPF or leave subscribers handicapped?

Curbs on withdrawal

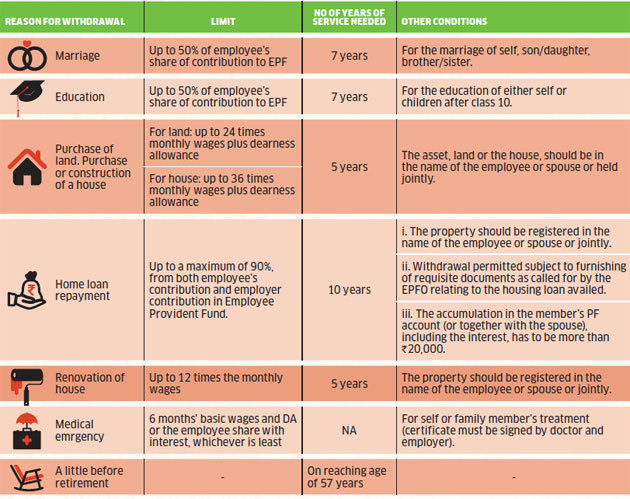

In the absence of a dependable pension offering, the PF serves as a nest egg for private sector employees. However, with many dipping into their PF kitty much before retirement, it often leaves the subscriber without a vital savings pool in their twilight years. A few years ago, the Employees’ Provident Fund Organisation (EPFO) had ruled that partial early withdrawal would only be permitted on occasions like a child’s marriage, higher education and making a downpayment for a house, subject to certain conditions.

Members are also allowed to withdraw the entire amount and opt for final settlement if they remain unemployed for more than two months. The EPFO has now changed rules for withdrawal in the event of loss of job. Members will be allowed to withdraw 75% of the accumulated corpus after a month of termination of service. If unemployed for two months, the member will have the option to withdraw the remaining 25% and go for final settlement.

Financial planners say restrictions on withdrawals will ensure retirement is not compromised. Yet, a certain degree of flexibility must to be retained to help those in crisis. Rohit Shah, Founder, Getting You Rich, says, “Many salaried individuals face a money squeeze at certain stages in life. The flexibility to withdraw PF money for key events needs to stay.” However, Suresh Sadagopan, Founder, Ladder 7 Financial Services, disagrees. “EPF is meant to be a retirement vehicle. If too much flexibility is given during the accumulation phase, it will be abused. This will hurt the individual’s retirement phase.”

Partial withdrawal of corpus is allowed for specific needs

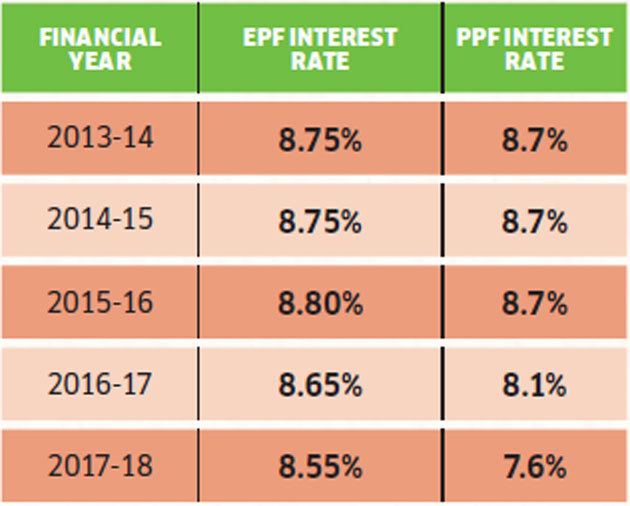

Until recently, the EPF generated returns entirely from investments in fixed income instruments like government securities and corporate bonds. Three years ago, the EPF entered the stock market, deploying a nominal 5% of the incremental corpus in equity exchange traded funds (ETF). The equity exposure has since been gradually hiked to 15% of the incremental corpus. In future, the subscribers may be given the option to deploy a higher portion of their equity contribution.

It would particularly benefit younger subscribers who have a higher risk appetite owing to the longer time horizon. They can step up their equity exposure from the early years and gain from the power of compounding. “For many individuals who consciously stay away from equities, the EPF may be the only way to participate in this high-growth asset class in a responsible manner,” says Sadagopan. As of May-end, the EPFO has invested nearly Rs 47,500 crore in equities, earning a return of 16.07% on the investment.

Unitisation of PF balance

Last year, the EPFO approved a change in the accounting policy for the portion of EPF invested in equities. The corpus parked in ETF will soon be credited to subscribers’ accounts in the form of units. These units can be redeemed by the subscriber when he or she exits the fund or withdraws the money. Meanwhile, earnings on the debt portion of EPF will continue to be paid as interest.

The Employee Pension Scheme, which runs parallel to the EPF, is also likely to see some changes. At present, employees earning up to Rs 15,000 a month are eligible for a minimum guaranteed pension of Rs 1,000 per month after retirement. All members become eligible for pension after 10 years of contribution to EPS. While employees contribute 12% of the basic pay to EPF, the employer has to make a matching contribution, divided into two parts: 8.33% of the basic pay is directed towards EPS—subject to a cap of Rs 15,000—and the remaining 3.67% is parked in EPF. The labour ministry may enhance the wage ceiling from Rs 15,000 to Rs 21,000. The retirement body is also considering doubling the minimum monthly pension for EPS subscribers to Rs 2,000.

The EPF may also be indirectly impacted by possible tweaks in the structuring of employee’s salary. According to reports, the government wants to cap allowances to employees at 50% of the basic pay. This proposal aims to make basic income a major component of the employee’s salary structure. Often, employers keep basic pay very low to ensure that the contribution towards social security schemes is also moderate, cutting down on company’s costs.

The EPF has seen some procedural tweaks in recent years. The EPFO has tried to simplify the subscriber’s interaction with the retirement body by offering services online. The introduction of the Universal Account Number or UAN is set to reduce complications during withdrawals and linking multiple PF balances. Once you are assigned a UAN, when changing jobs, sharing the UAN with the new employer will enable them to get your entire PF balance transferred to the new account.

1. Go to the EPFO’s Unified Member Portal for UAN related services.

2. Select the ‘Know your UAN status’ option under ‘important links’ section.

3. Enter details like member ID or EPF account number, name, date of birth, phone number and email. EPF member ID is printed on your salary slip.

4. You will get an authorisation PIN on the registered mobile number.

5. After entering the PIN, your UAN will be sent to the registered mobile number and email.