LIC Bima Shree Plan 848 is a money back plan with Guaranteed Addition feature. This plan will be available from 16th March 2018. Whether can we buy LIC Bima Shree Plan 848? Let us see it’s features and benefits in detail.

It is a non-linked, with profits, limited premium payment money back plan. This plan offers the minimum sum assured of Rs.10 lakh and as per LIC’s claim designed to target the HNIs.

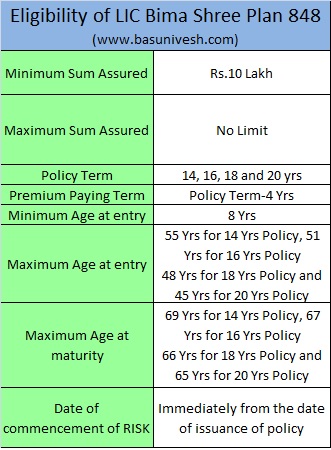

Eligibility of LIC Bima Shree Plan 848

First, let us see the eligibility condition of LIC Bima Shree Plan 848.

Features of LIC Bima Shree Plan 848

- Unlike the typical traditional plans of LIC, this plan will be eligible for paid-up immediately after the completion of 2 years. For all other policies of LIC, paid up feature will be applicable if you paid the premium for at least 3 years.

- As the policy is eligible for paid up after 2 years, you are eligible to surrender the policy immediately after the 2nd year completion.

- You can avail the loan after a year of the policy.

- This plan offers the riders like Accidental Death and Disability Benefit, Accident Benefit, New Term Assurance Rider, Critical Illness rider and premium waiver rider. However, the policyholder can opt either Accidental Death and Disability Benefit or Accident Benefit. Hence, one can avail the maximum of 4 riders in this plan.

- You can pay the premium yearly, half-yearly, quarterly or monthly.

Benefits of LIC Bima Shree Plan 848

Now let us see the benefits available under LIC Bima Shree Plan 848.

# Guaranteed Addition under LIC Bima Shree Plan 848

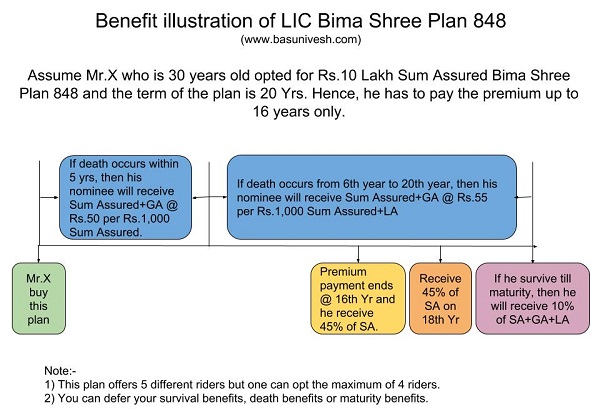

This plan offers the guaranteed addition. For the first 5 years, the guaranteed addition will be Rs.50 per Rs.1,000 Sum Assured.

From 6th year onward to till POLICY PREMIUM PAYING TERM, this plan offers the guaranteed addition of Rs.55 per Rs.1,000 Sum Assured.

Along with this, this plan is eligible for Loyalty Addition also (which is one-time payment either at maturity or death of the policyholder).

# Death Benefits of LIC Bima Shree Plan 848

There are two conditions to pay the death benefits under this plan and they are as below.

a) Death during the first 5 years of the policy period

If death occurs during the first 5 years of the policy period, then the benefit is as below.

Sum Assured on death+Guaranteed Addition at Rs.50 per Rs.1,000 Sum Assured.

b) Death from 6th year to policy maturity date

Sum Assured on death+Guaranteed Addition (for first 5 years Guaranteed Addition will be at Rs.50 per Rs.1,000 Sum Assured and from 6th year onward it will be Rs.55 per Rs.1,000 Sum Assured)+Loyalty Addition.

Meaning of “Sum Assured on Death” is defined as HIGHER of the below.

- 10 times of your annual premium (excluding taxes, the extra amount due to underwriter decisions or rider premium)

- 125% of Basic Sum Assured.

- 105% of all the premiums paid as on date of death.

You can also defer the death benefits payable to your nominee in installments rather than a lump sum payment is chosen over the period of 5 yrs, 10 yrs or 15 yrs. This can be exercised by the policyholder during his lifetime only. Based on this, the nominee will receive the death benefits at a deferred period set by the policyholder. Nominee can’t alter this feature. This can be either % of the death benefit or absolute value of money.

The installments will be payable in advance by LIC in the mode the policyholder opted. The interest rate on such payment will be decided by LIC from time to time.

# Survival benefits of LIC Bima Shree Plan 848

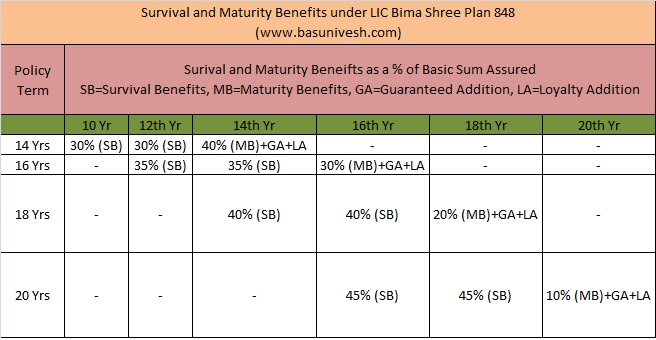

If policyholder survives to each of the specified duration during the policy term, a fixed % of Basic Sum Assured will be payable. This fixed % is as below.

- For 14 Yrs Policy-30% of Basic Sum Assured on each 10th and 12th policy year.

- For 16 Yrs Policy-35% of Basic Sum Assured on each 12th and 14th policy year.

- For 18 Yrs Policy-40% of Basic Sum Assured on each 14th and 16th policy year.

- For 20 Yrs Policy-45% of Basic Sum Assured on each 16th and 18th policy year.

Like death benefit deferred benefit, this policy offers you to take the survival benefit at the deferred date (postponing the payment receivable). You can receive the survival benefit as per your with along with interest at a later stage of your requirement.

However, you have to defer this survival benefit up to policy maturity only. Before that, you have to receive this benefit along with interest. If you do not take this deferred survival benefit and interest before maturity, death or surrender, then LIC will pay this during maturity, death or surrender time along with interest.

The interest will be yearly compounding but the rate will be fixed by LIC from time to time.

You have to inform this deferred survival benefit receiving option 6 months prior to the actual due date of survival benefit. Otherwise, LIC will pay you the survival benefits as per the due dates.

# Maturity benefits of LIC Bima Shree Plan 848

If policyholder survives up to the policy period, then he will receive the below benefits.

- For 14 Yrs Policy-40% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

- For 16 Yrs Policy-30% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

- For 18 Yrs Policy-20% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

- For 20 Yrs Policy-10% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

Let me explain the same of both survival benefits and maturity benefits in below sheet for your simple understanding.

Let me explain the whole benefit illustration with below image.

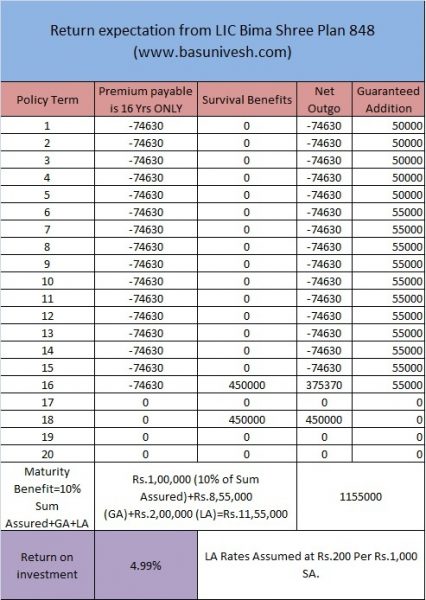

What returns we can expect from LIC Bima Shree Plan 848?

Let us take an example of a person whose age is 30 years and he opted for Rs.10 Lakh LIC Bima Shree Plan 848 with the term opting as 20 years. Hence, his premium paying term will be 16 years. Below is the return expectation from this plan. The premiums are inclusive of ADDB and GST.

You noticed that returns are as usual on expected term. If we exclude the GST or ADDB, then the returns may be around 6%. Hence, even though returns are GUARANTEED in this plan, it is not worth to invest in such low yielding product.

Review of LIC Bima Shree Plan 848

# As per LIC’s claim, this plan is designed to HNIs. Hence, if you can afford the premium then you can buy it.

# The new feature what I saw under this plan is that this plan is eligible for paid up, surrender and loan immediately after two-years completion of the policy period. Usually, LIC plans eligible for paid up and surrender after 3 years. However, LIC reduced this to two years for this plan. In my view, LIC reduced this to two years to make sure that LIQUIDITY must not be an issue.

# GUARANTEED Addition is an EYE CATCHING feature of this plan. But the biggest catch this time by LIC is that this GUARANTEED addition is available up to your premium paying term. After that, your invested money will not earn a SINGLE RUPEE. Also, do remember that such yearly accumulated guaranteed addition will not earn a single rupee on it. LIC just keeps this with it and pay you at surrender, death claim or at maturity. Hence, never enter into this plan with the hope that GUARANTEED means the BEST PLAN.

# If death occurs within 5 years of the policy period, then your nominee will receive SA+GA @ Rs.50 per Rs.1,000 SA. However, if death occurs after 5th year to policy period, then your nominee will receive SA+GA @ Rs.55 per Rs.1,000 SA. Hence, the probability of your nominee receive during the first 5 years is less.

# LIC now started to offer to defer the survival benefit, death benefit and maturity benefits to its plans. However, choosing such options blindly without knowing the interest rate offered by LIC is like a BIGGEST mistake. Because, if death occurs, then-nominee has no rights to change these options. The nominee has to continue with the option which policyholder selected. Hence, be careful while exercising this option.

Conclusion:-There is nothing new in this plan other than offering to HNIs (setting minimum sum assured as Rs.10 lakh), deferring your survival, death and maturity benefits, inbuilt critical illness rider and eligibility for paid up and surrender within a year.

Instead, if go for term life insurance and invest the same in PPF (yearly maximum limit is Rs.1.5 lakh) (forget about equity products), then you may earn more than this plan.

Rest of all features looks like TYPICAL LIC MONEY BACK PLAN. Nothing new to run behind this product and invest. However, if you feel 5% to 6% returns BEST for you by investing such a long period, then definitely GO AHEAD!! Else simply skip this product. Because in my view, this is meant for agents to garner huge business from a single plan selling.

Source by basunivesh…

Share: