Recently LIC declared the bonus rates for the year 2017-18. Let us see the complete details about LIC Bonus Rates for 2017-18 and how they affect your life insurance returns.

What is the meaning of bonus for LIC policies?

When you buy a traditional with profit product from LIC, then your returns from such policy mainly depends on what will be the rate of bonus. LIC declares bonus on the yearly basis. Usually, you will not find any such drastic change. But it is always better to track the bonus rates.

Let us say you bought LIC’s Jeevan Anand for the term of 20 years and sum assured as Rs.5,00,000. If LIC declared bonus as Rs.45 for this product, then the calculation will be as below.

The bonus rates will be based on three criteria.

# Term of policy-Higher the tenure means higher the rate.

# Sum Assured-LIC bonus depends on per Rs.1,000 of Sum Assured. Hence, if you bought higher sum assured policy, then your bonus accumulation will be at the higher end.

So from above example, if LIC declared you Rs.45 as bonus per Rs.1,000 sum assured for 20 years policy, then the bonus accumulation for that year will be as below.

Rs.22,500=(Rs.45 x Rs.5,00,000)/Rs.1,000.

Remember this Rs.22,500 will not be payable to you. But it will be with LIC and you receive this amount during the time of death claim or maturity. The most important point to note that they will not add any amount on this Rs.22,500. It will remain same till the period of death claim or maturity date.

How to calculate returns for your LIC policy?

In simple, I explained how to calculate bonus for a year. But LIC offers different products like the endowment, limited endowment or money back plans. In such a situation, you may find it difficult to calculate returns on your LIC plan. Hence, I created a video about this.

This below video will explain you about how to calculate returns on your LIC plans using excel sheet. It is too simple and convenient for you to calculate.

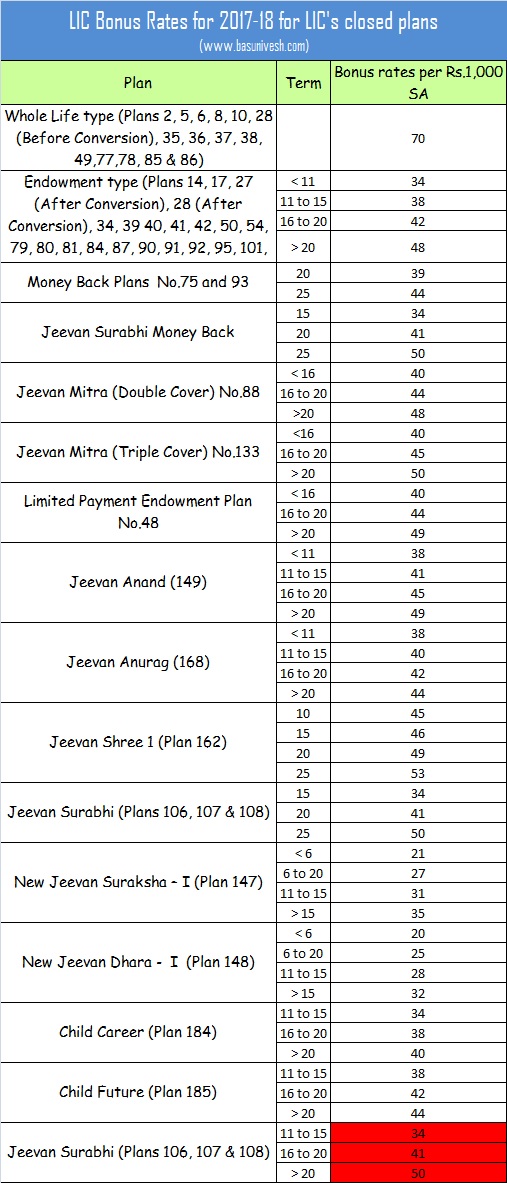

LIC Bonus Rates for 2017-18 for closed plans

Hope you got the clarity about the importance of bonus rates for your traditional plans. Now let us concentrate on recently declared LIC Bonus Rates for 2017-18.

The below reversionary bonus rates are applicable for policy year entered upon during the inter valuation period i.e. 01/04/2016 to 31/03/2017 and in force for full sum assured as on 31/03/2017. It would apply to policies resulting into claims by death or maturity (including those discounted within one year of maturity) or surrendered on or after 01/01/2018.

The above interim bonus rates are applicable to policies in respect of each policy year entered upon after 31/03/2017 and result into claims by death or maturity (including those discounted within one year of maturity) or are surrendered during the period commencing from 01/01/2018 and ending 9 months from the date of next valuation.

No cash bonus has been declared in respect of New Jeevan Akshay – I (Plan 146).

This time, I separated the plans in two ways. One for the old policies which are closed and another list for the new policies which are currently available for purchase.

Note-The Bonus rates which are marked in red are changed from earlier rates. For example, earlier for Jeevan Surabhi (Plans 106, 107 and 108), the bonus rate for 11 to 15, 16-20 and above 20 years plans was Rs.38, Rs.42, and Rs.44 respectively. Not it changed to Rs.34, Rs.41, and Rs.50 respectively.

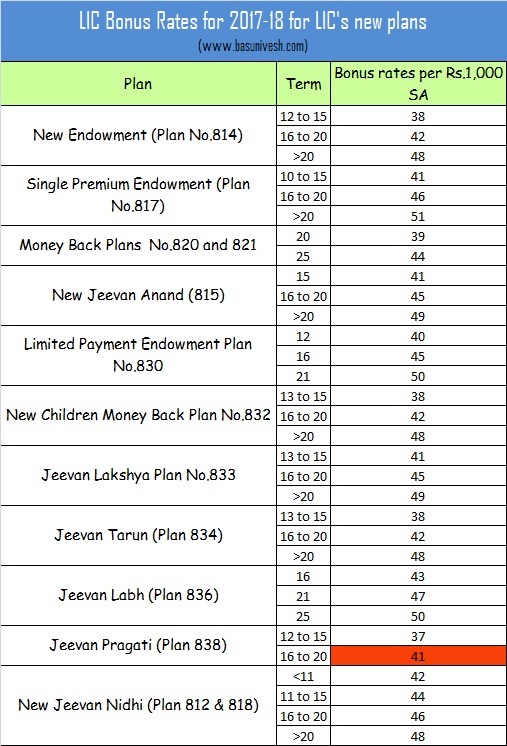

LIC Bonus Rates for 2017-18 for new plans

Let us now look at the bonus rates of the new plans which are currently offered by LIC.

Note-For Jeevan Pragati (Plan 838), earlier for policies whose term is between 16 years to 20 years was Rs.40. But now it increased to Rs.41.

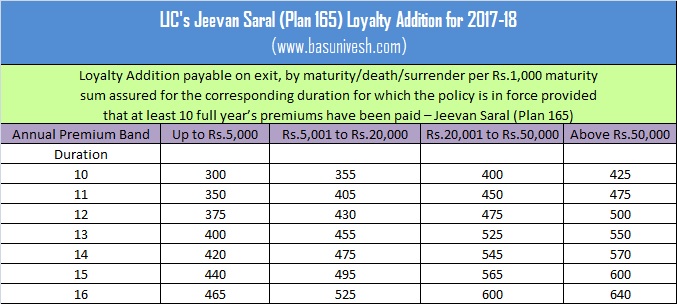

LIC’s Jeevan Saral (Plan 165) Loyalty Addition for 2017-18

For LIC’s Jeevan Saral, Bonus will not apply. But it is LA based on the MSA (Refer my post “LIC’s Jeevan Saral-Why so much confusion?). This was the LIC’s special plan. Let us see the LA rates for this plan.

Along with Simple Reversionary Bonus, LIC also declares other types of bonuses like;

- Final Additional Bonus (FAB):It is paid to those policies which are of a longer duration and has run for say more than 15 years. This is the one-time payment payable either at the death of policy holder or at maturity.

- Loyalty Additions: LA is exactly like FAB. Few features offers such LA than Bonus (For example Jeevan Saral)

- They are paid as per the policy features and conditions. No LA will be payable if you surrender the policy in between (except Jeevan Saral).

Note-It is hard for me to share all plans FAB and LA rates. Hence, if you have a specific query related to FAB or LA rates, then you can comment it here and I will try to share the same.

Source by:- basunivesh

Share: