Are you an SBI customer? If yes, then it is in your own interest to be aware of the various charges imposed by your bank on various transactions, so that you don’t have to pay anything extra while doing any transaction.

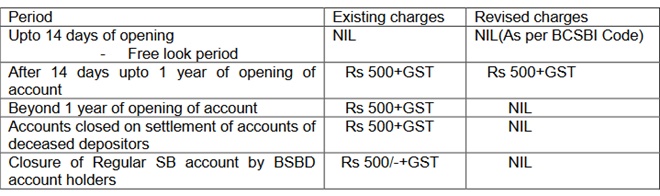

Are you, for instance, aware that the State Bank of India charges Rs 500 plus GST for closing a savings bank account after 14 days and up to 1 year of opening the account? However, from 01.10.2017, no charges are levied beyond 1 year of opening the account. Earlier, the bank used to charge Rs 500 plus GST even if the account was closed after one year of its opening. Similarly, no charges will be levied if the accounts are closed on settlement of accounts of deceased depositors or if a BSBD account holder is closing his regular SB account. Earlier, the bank used to charge Rs 500 plus GST for these services also.

The revised Savings Bank Account closure charges

SBI has also revised its service charges from April 1 this year for non-maintenance of monthly average balance (MAB) in savings bank accounts. For instance, the charges for non-maintenance of MAB for the metro and urban centre customers have been reduced from a maximum of Rs 50 per month (plus GST) to a maximum of Rs 15 per month (plus GST). Similarly, charges for the semi-urban and rural centre customers have been cut from a maximum of Rs 40 per month (plus GST) to a maximum of Rs 12 and Rs 10 per month (plus GST), respectively. Also, the requirement for MAB in metro and urban centres stands reduced to Rs 3,000 from Rs 5,000 earlier.

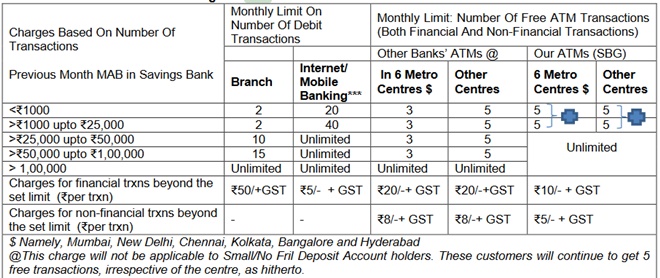

So far as ATM transactions are concerned, SBI allows unlimited free transactions at its group ATMs to its customers who have maintained monthly average balance of above Rs 25,000 in their savings bank account in the previous month. However, in case of other banks’ ATMs, the number of free transactions gets limited to 3 in the 6 metro centres and 5 in other centres in case the MAB is above Rs 25,000 and up to Rs 100,000 in the previous month. But if the previous month’s MAB is above Rs 100,000, then unlimited ATM transactions are allowed in other banks’ ATMs also.

The number of free ATM transactions, however, include both financial and non-financial transactions, as per information available on the bank’s website.

Source:- financialexpress

Share: